Yes, rates move the needle. When 30-year fixed rates jumped from ~2.65% (early 2021) to ~7.8% (2023), the principal and interest on a $400,000 loan climbed by $1,200+/mo. A $400k mortgage at ~3.5% can even beat the payment on a $300k mortgage at ~6%. That’s the power of the rate.

But here’s the part that helps you breathe a little: rate is only one lever. Home price, down payment, property taxes (big in Texas), insurance, HOA dues, and mortgage insurance (PMI) all shape your real monthly number. And smart buyers don’t chase a headline rate, they design a payment they can live with and then use multiple levers to hit it. As housing economist Lisa Sturtevant warns, “timing rates” is usually a fool’s errand; volatility alone can change your payment week to week. This guide shows you, in simple visuals and real Austin-friendly scenarios, how rates change payments and what else you can adjust to keep your budget comfortable.

The mortgage world is notorious for acronyms and jargon that can make your eyes glaze over. We condense the key terms you’ll encounter into a bite-sized glossary with simple definitions.

For example:

Keeping definitions like these handy in normal language can demystify the process. When you get your Loan Estimate or talk with your lender, you can refer to this sheet and feel empowered, not intimidated.

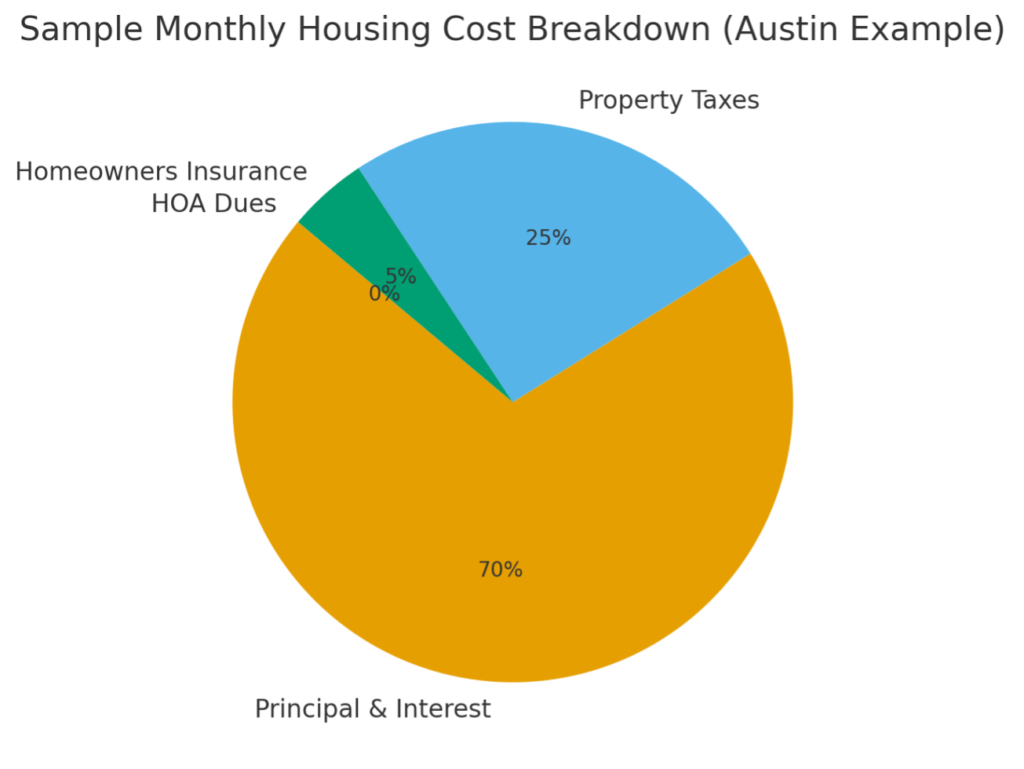

When lenders say “PITI,” here’s what they mean:

Domum Tip: Think total payment (PITI + HOA/PMI), not just rate. A 0.25% rate bump might add only a few dozen dollars to P&I, something you could offset with a slightly lower price, a touch more down payment, or cheaper insurance.

See how non-rate items stack up.

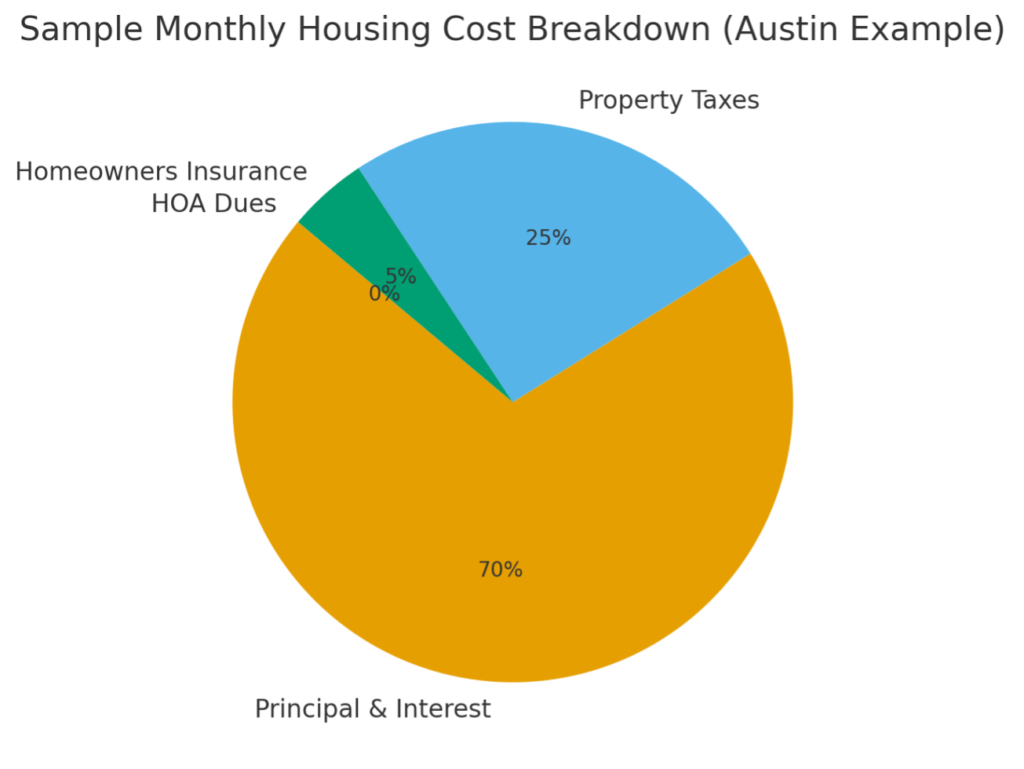

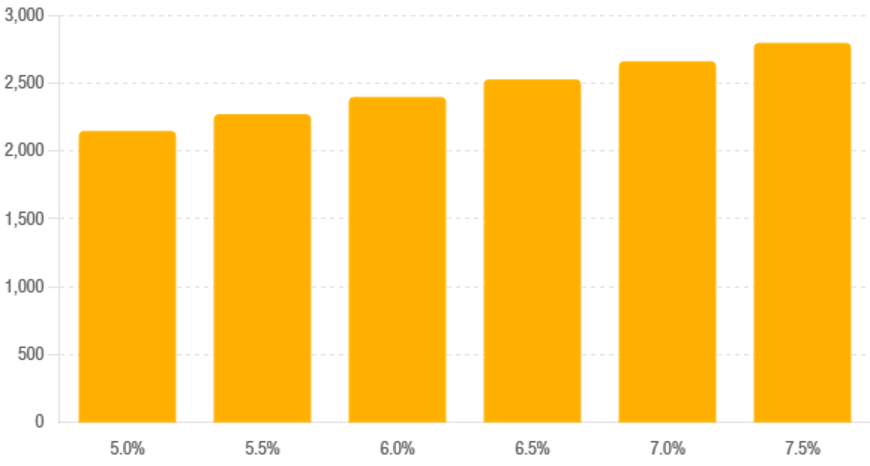

Rates act like a volume knob. Each notch higher makes your P&I payment jump, and the “steps” get taller at higher rates because of compounding.

What to notice:

Use this “staircase” to pick your comfort step: if 6.5% strains you, what price or credits get you to the 6.0% step—or, alternatively, what lower price keeps you comfy at 6.5%?

Let’s translate rate moves into everyday choices.

That’s a month of streaming services or a family takeout night. Small rate dips still matter, especially when you’re early in your budget.

About a nice dinner for two or a cell-phone family plan, $1,584/yr back in your pocket.

Decide you’re comfortable with $3,000/mo for P&I, then work backwards.

A modest rate dip can add **$25k** in purchasing power or let you keep the same price and just save the cash.

Pay an upfront fee (1 point = 1% of the loan) to shave your rate, often ≈0.25% per point. Example: on $300,000, 1 point ($3,000) might cut your payment by ~$48/mo. Break-even ≈ 63 months, so points make sense if you’ll keep the loan long enough. If you’ll move/refi sooner, that cash may be better used for down payment or reserves.

A 2-1 buydown makes Year 1 2% lower than your note rate and Year 2 1% lower, then you go back to the note rate.

Funded upfront, often by a seller/builder credit. You must still qualify at the full note rate, so think of it as a soft landing while you settle in, with a potential refinance if rates fall.

Who pays? Credits can come from the seller, builder, lender, or sometimes the buyer (program-dependent). In practice, concessions from sellers/builders are most common—and extremely negotiable in Central Texas right now.

Lower price or higher down = smaller loan = lower P&I. Texas down-payment assistance (e.g., My First Texas Home or Home Sweet Texas) can cover up to ~5% for eligible buyers, helpful to reduce the loan or cover closing costs. Even a $10k price cut saves ~$50/mo at ~6%, small alone, but powerful when stacked with other levers.

Better credit tiers = better pricing. The difference between a high-700s score and the low-600s can be well over 1% in rate, hundreds per month on typical Austin loan sizes. Give yourself 60–90 days to clean up balances and errors before you shop.

Ask the seller for credits and use them to buy down the rate or cover fees. $10k in credits can often lower your payment 2x more than a $10k price cut. Builders in Greater Austin frequently advertise rate buydown incentives, take them.

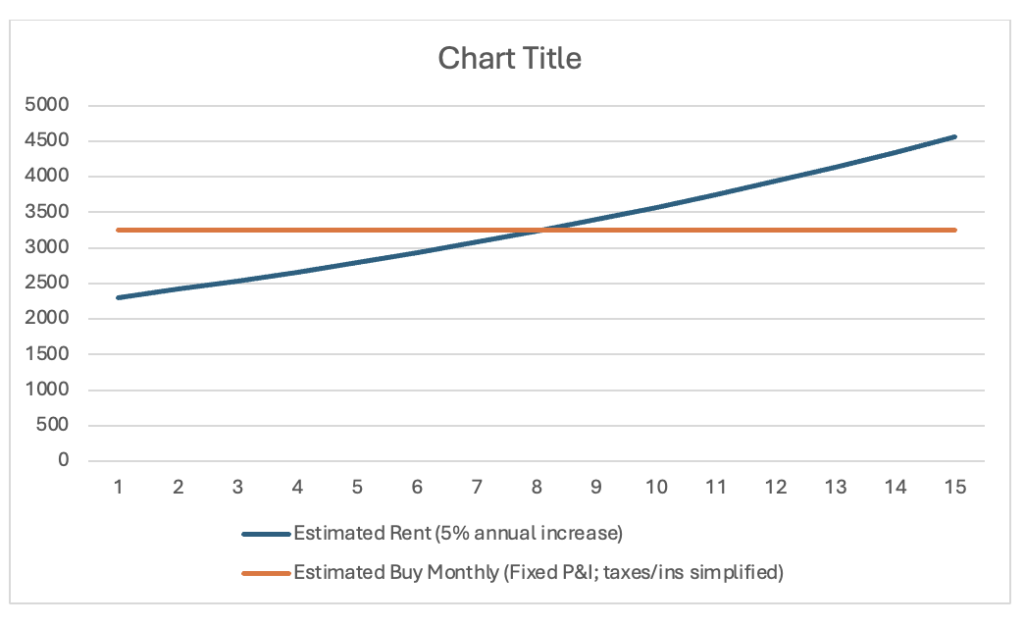

Short-term, renting can look cheaper than owning in Austin because of prices and property taxes. But homeownership converts part of your payment into equity (principal), a built-in savings plan, and locks in P&I for 30 years (vs. rent hikes). If you’ll stay put for several years, owning often wins long-term.

“Date the rate, marry the house.” — Common industry maxim; discussed by Rachel Cruze (Ramsey Solutions). If today’s payment works, you can refinance later if rates fall. Refinancing has costs, so most buyers look for roughly ~0.75–1.0% better rate to make a refi worth it within a couple of years.

Rates mostly respond to inflation, jobs data, and Fed signals l, with inflation the prime mover. A hot jobs report can nudge rates up; cooling inflation often eases them down. The Fed doesn’t set mortgage rates directly; markets move on expectations.

How to skim headlines like a pro:

Domum Snapshot: We keep clients updated with a monthly, hype-free one-pager: where rates sit, what changed, and what levers we’re using right now in Austin.

Fact: Perfect rarely arrives. Buy when the payment fits, then refi if/when it makes sense.

Fact: Only if the break-even (often 4–6 years) matches your timeline. Otherwise, keep the cash.

Fact: Nice if you can, but 3%–5% (or VA/USDA 0% if eligible) can be smarter than waiting years while prices/rents rise. PMI can be temporary.

Fact: No guarantees. Use credits/structure to win the payment today, refi later if opportunity knocks.

Fact: Points are prepaid interest. They pay off only after break-even. Great for forever homes; not for short timers.

Fact: Markets trade off. High-rate periods can bring better pricing and concessions. Play the hand on the table.

Instead of only haggling on price, ask for seller credits and apply them where they do the most good, rate buydowns or closing costs.

Example move: Home listed at $500k. Rather than pushing to $480k, offer $500k with $20k back in credits. Use ~$15k to permanently buy down your rate (say from ~7% to ~6%) and ~$5k for closing costs. Your monthly likely drops more than a simple $20k price cut would—and you keep more cash at closing. Sellers like it because their recorded sales price stays strong; you like it because your payment does.

Pro tips

Q: APR vs interest rate, what do I watch?

Interest rate sets your monthly P&I; APR bakes in most fees/points to reflect true cost over time. Compare APR across similar loans, use the rate to understand your payment today.

Q: Fixed vs ARM, who should consider an ARM right now?

If you know you’ll sell/refi in 5–10 years and want a lower start rate, a 5/6 or 7/6 ARM can make sense. If you’ll stay long-term or hate surprises, stick to a fixed and refi later if rates drop.

Q: When is refinancing “worth it”?

Run a break-even: refi costs ÷ monthly savings. Under ~24 months is a solid target; in 2025 many buyers need roughly ~0.75% better rate to make a refi pay off in ~3 years. Loan size and costs matter.

Q: How early should I get pre-approved?

About 60–90 days before you shop is perfect. It doesn’t lock you to a lender; it simply proves you’re ready and helps you move fast on the right home.

You can’t control the national rate sheet but you can control your outcome. Start with a payment you can enjoy, then combine levers:

That’s how you buy confidently in Austin, even when the market’s noisy.

Reach out to Domum Realty—we’ll guide you on your housing journey.

Sources